Currency hedge rebalancing: resist the fixed idea

Many Swiss institutional investors routinely rebalance their foreign currency hedges at the London fix on the last working day of the month. Whether this is done for convenience, tracking error or liquidity reasons, we show that significant sums of money can be saved by anticipating these readjustments, especially when they are expected to be large. Unbalanced flows as well as banks’ and speculators’ activity conspire to create a disadvantageous trading environment at the end-of-month fix for investors.

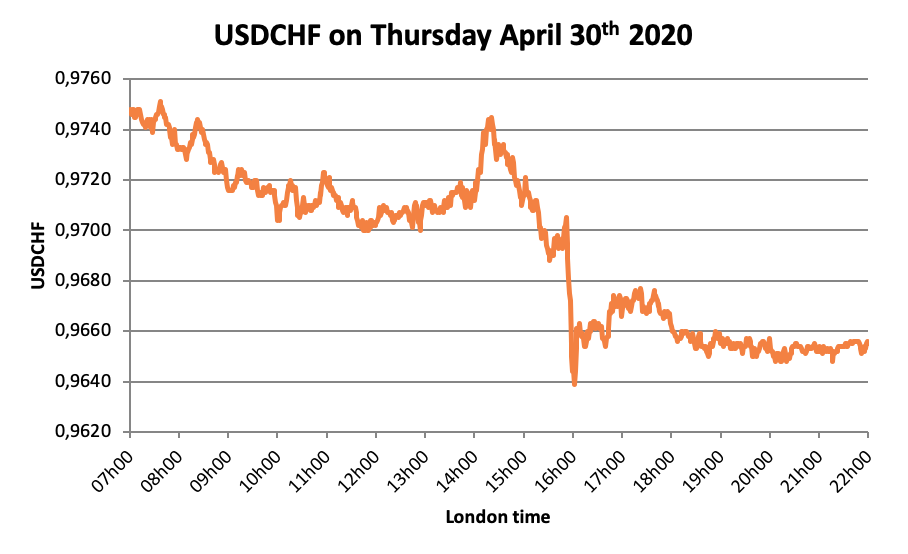

So what happened?

Despite the bad session risky assets experienced on April 30, US stocks were up 23% for the month up until that day while European stocks were up 8%, as equities bounced back from their coronavirus-induced bottom.

For Swiss institutional investors, this meant the value of their foreign assets increased substantially and so did their exposure to foreign currencies. Moreover, it is common practice for them to both hedge a significant part of their foreign currency exposure and to adjust the size of this hedge at 5 pm Switzerland time on the last working day of the month. This corresponds to 4 pm in London, when benchmark exchange rates are computed for various currency pairs. This combination of factors implied that many investors would be selling USDCHF around the same time, thereby causing the rapid drop. The size of this move is far from insignificant. Imagine an investor having to increase the hedge on his USD 100 mio portfolio of US stocks by 23% and deciding to perform the transaction (i.e. sell 23 mio USDCHF) at 3 pm instead of 4 pm London time. The investor would have saved CHF 163’300 thanks to the USDCHF dropping by 71 pips over the subsequent hour. This is why PPI recommended to its clients, at the end of April 2020 just as for any months when large one-sided hedge re-adjustments were expected, to execute the related transactions ahead of time and avoid these massive costs.

The London 4pm fix But why do many large investors decide to execute their rebalancing trades at 4pm London time? As we mentioned, this is when reference exchange rates (“fixes”) are calculated each day by WM/Reuters and referred to widely throughout the investment management industry. For example, MSCI’s indexes that contain assets in different currencies are revaluated daily using these reference rates. The rates represent the median of transactions sampled every second in a 5-minute window around 4pm.

An eventful first half of the year

Unusual price activity around the fix since the beginning of 2020 has not gone unnoticed. On April 17th, the Financial Times reported that the price swings observed daily in March were twice as large as for previous months, increased trading costs for investors and suggested manipulation by market participants.*

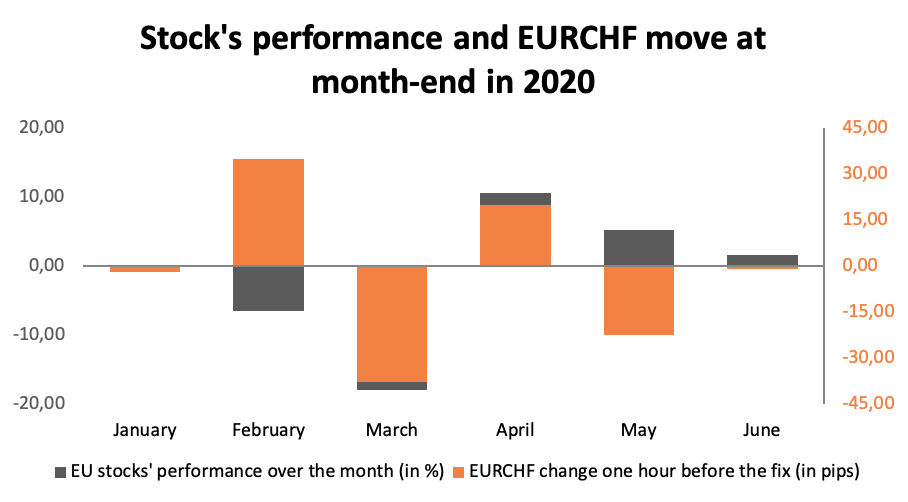

Interestingly, and although quarter-end and month-end rebalancing forces should have compounded, the impact on the USDCHF for March 31st was only a third of what happened at the end of April and which we detailed at the start of this paper. Despite April 2020 being an extreme event, the end-of-month pattern described in the previous section has been holding surprisingly well for the first half of the year. The graph below shows the US stock performance over the month in red (our proxy for foreign currency hedge rebalancing) and the change in the USDCHF exchange rate in the hour preceding the 4 pm London fix in blue. We can see that they are systemically of the opposite sign, as expected given that an increase of the value of the foreign portfolio leads to an additional selling of the foreign currency to neutralize the associated currency risk and puts a downward pressure on the USDCHF exchange rate (and inversely). Moreover, the sizes of these opposite moves seem to be correlated, with larger anticipated hedge re-adjustments associated with larger moves in the exchange rate. *Vincenzo Pinto, “Unusual price swings around daily forex “fix” trigger alarm”, Financial Times, April 17th 2020.

For EURCHF, the effect is neither as clear-cut nor as significant which presumably comes from different sources. First, Swiss investors generally hold around three times more dollars than euros in their portfolio, meaning the amounts to be rebalanced are that much smaller.

Second, and related to this, the sheer size of the US equity market ($30+ trillion) implies that imbalanced hedge re-adjustments stemming from international portfolios exposed to the dollar impact other currency pairs such as the EURUSD. On April 30th 2020 for example, the EURUSD moved up by around 80 pips between 3 and 4 pm London time. This inevitably puts an upward pressure on the EURCHF, dampening or even negating the impact of the order imbalance in that currency pair. Another reason we can invoke are the massive interventions by the Swiss National Bank (SNB) over this period of time, effectively providing a form of put option for Swiss investors who may have reduced their overall hedge in this currency pair. Indeed, if the EURCHF goes down, one would expect the SNB to limit or stop the trend whereas if it goes up, an absence of hedge allows the investor to reap the benefits of the appreciating foreign currency. As an anecdotal evidence providing support for this proposition, we have seen a large fall in the EURCHF over the hour preceding the end-of-month fix in January 2015 despite a small increase in European stocks’ value over the month. Swiss investors deciding to increase their hedge following the abandonment of the 1.20 floor by the SNB on that particular month might explain this.

The cost of convenience

The evidence presented so far argues for the monthly re-adjustments of currency hedges to be made ahead of the fix, especially when these amounts are large.

To get a better picture of the merits of such a policy change, we go back to 2015* and compute how much would have been saved by trading one hour before the fix for both the USDCHF and EURCHF. The results are featured in the table below. *We start our analysis in 2015 following the reform of the WM/Reuters fix computation methodology, which saw the increase of the time window from 1 minute to 5 minutes in an attempt to make the benchmarks more resilient to possible collusion between banks.

Yearly gain/loss of rebalancing 1 hour ahead of the fix (in pips)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Average | |

|---|---|---|---|---|---|---|---|

| USDCHF | -97 | 16 | 83 | 67 | 62 | 166 | 49.50 |

| EURCHF | 102 | -79 | -13 | 23 | -42 | 79 | 11.67 |

A couple of things stand out. First, 2020 has indeed been a remarkable year for both currency pairs, especially given that our sample ends in June. Second, the strategy works better for USDCHF with an average yearly gain of 49.5 pips, almost 5 times that of the EURCHF (even though both performance numbers are positive). This finding resonates with our previous analysis of 2020 numbers presented in the previous section. Moreover, the performances for the two currency pairs appear to be somewhat uncorrelated, suggesting they do not share the same exact drivers.

Yearly gain/loss of rebalancing 1 hour ahead of the fix (in basis points of exposure & CHF)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Average | Average in CHF (USD; EUR 100m exposure) | |

|---|---|---|---|---|---|---|---|---|

| USDCHF | 1.39 | 0.64 | 2.76 | 2.66 | 3.52 | 25.24 | 6.58 | 92'840 |

| EURCHF | 7.23 | -4.38 | -0.34 | 1.41 | -0.89 | 8.62 | 2.12 | 21'046 |

The bottom line

At PPI, we believe that investors looking for increased liquidity at the fix have been misled. This is why we have always recommended that they allow themselves the flexibility to execute their trades proactively ahead of the fix, provided they benefit from an excellent trading infrastructure given the competitiveness of the market at these hours.

The optimal execution time can be determined by the currency manager who considers different market drivers affecting flows and liquidity not limited to the analysis showcased in this paper. If their benchmark remains the London fix, investors would be exposed in part to currency risk over a few minutes or hours, but the results we’ve presented indicate they would be well compensated for it especially when large rebalancing trades are anticipated. Importantly, we don’t see these effects vanishing as long as strong incentives remain for some large investors to trade at the fix and for other market participants to exploit it. Currency managers typically charge between 1 and 2 basis points per year for implementing a passive hedging program. For this price, an investor can have, among other things, access to a service that would have saved them around 6.6 basis points per year since 2015 on their USDCHF exposure (c.f. Table 2) solely by adjusting rebalancing trades in a way that benefits them more. Ultimately, we consider it a risk for investors to opt for convenience, tie themselves to a benchmark, hope that banks have their best interest at the top of their priority list and that markets are liquid and balanced enough that their trades will be executed at decent conditions. In our experience, the only sure outcome in this type of setup is that profits are made at the expense of the investor.